Skin Fight Club: Unleash Your Best Skin

Join the fight for flawless skin with tips, tricks, and product reviews.

Withdrawal Whirl: Navigating Methods and Fees Like a Pro

Master the art of withdrawals! Uncover the best methods and fees to maximize your profits like a pro in Withdrawal Whirl. Don’t miss out!

Understanding Withdrawal Options: A Comprehensive Guide

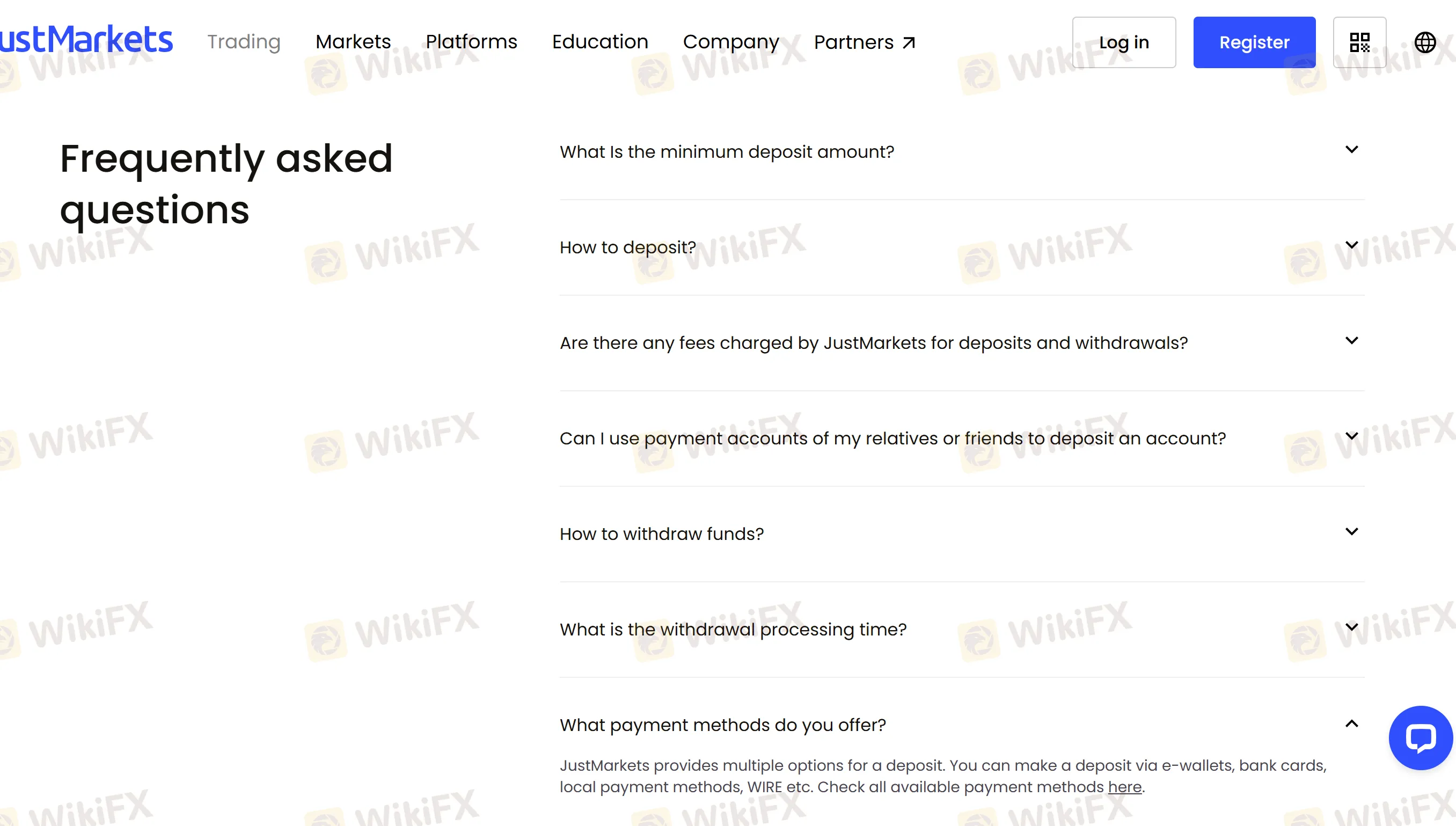

When it comes to managing your finances, understanding withdrawal options can be crucial for maximizing your earnings while minimizing potential losses. Different financial institutions and investment platforms offer various methods for withdrawing funds, including bank transfers, checks, and e-wallets. Each option has its own advantages and disadvantages, making it essential to evaluate which method aligns best with your needs. For example, while bank transfers offer reliability and security, they may incur higher fees or longer wait times compared to e-wallets, which often provide faster access to your funds.

Moreover, it is equally important to understand the withdrawal limits and associated fees that may apply when using different withdrawal methods. Some platforms impose daily or monthly limits on withdrawals, while others may charge fees based on the amount or frequency of transactions. To help you navigate these complexities, here are some factors to consider when selecting your withdrawal option:

- Speed: How quickly do you need access to your funds?

- Cost: Are there fees associated with your chosen method?

- Convenience: Is the method user-friendly and accessible?

By thoroughly understanding your withdrawal options, you can make informed decisions that align with your financial goals.

To enjoy exclusive offers and bonuses, make sure to check out the latest duel promo code available. This code can provide you with great savings on your next gaming session.

Hidden Fees Unveiled: What You Need to Know About Withdrawal Costs

When managing your finances, understanding withdrawal costs is essential to avoid unexpected surprises. Many financial institutions and services impose hidden fees that can significantly impact your overall savings or investment returns. These fees can include transaction costs, processing fees, or minimum withdrawal limits that may not be clearly disclosed upfront. To better navigate these potential pitfalls, it’s crucial to thoroughly read the terms and conditions associated with your account and ask questions if any fees are unclear.

Additionally, it's wise to keep in mind that different platforms can have varying fee structures. Here are some common withdrawal costs you should watch for:

- ATM fees

- Wire transfer fees

- Account closure fees

- Currency conversion fees

Being proactive about understanding these charges allows you to make more informed decisions, ultimately protecting your finances and maximizing your return on investment.

How to Choose the Best Withdrawal Method for Your Needs

When it comes to choosing the best withdrawal method for your needs, it's essential to consider factors such as speed, fees, and convenience. Start by evaluating how quickly you need access to your funds. For instance, e-wallets like PayPal or Skrill often provide instant withdrawal options, while bank transfers might take a few business days. Additionally, transaction fees can vary significantly between methods. Make sure to compare the costs associated with each option to avoid unexpected charges that could eat into your funds.

Another important aspect to consider is the security of the withdrawal method. Ensure that whatever option you choose is reputable and offers robust protection against fraud. It's also wise to look for methods that comply with the regulations in your country. A popular withdrawal method may not always be right for you; therefore, it's crucial to research and read reviews before making a decision. Ultimately, picking a withdrawal method that aligns with your preferences and provides peace of mind is essential for a satisfactory financial experience.